No provision of the Tax Cuts and Jobs Act is more closely followed by entrepreneurs than the new ‘20% pass through deduction’. In its simplest form it’s pretty straight forward. But as in all things tax, it’s the details that make the difference on whether and how it works for you.

No provision of the Tax Cuts and Jobs Act is more closely followed by entrepreneurs than the new ‘20% pass through deduction’. In its simplest form it’s pretty straight forward. But as in all things tax, it’s the details that make the difference on whether and how it works for you.

So here’s a good plain-English breakdown of how the deduction works.

Who Qualifies?

First off, who does this new deduction even apply to?

The actual text of law states: “In the case of a taxpayer other than a corporation, there shall be allowed a deduction…”. What this means, is that any sole proprietor filing a Schedule C on their personal return, any S-corporation shareholder, and any partner in a partnership, is potentially eligible for this deduction.

So what if you’re an LLC? Remember that LLC’s aren’t actually a type of tax entity (which are defined by the IRS), but rather a type of legal entity (which are defined by your state). (See our blog post Choosing the Best Tax Structure for your Business for more information.) And LLC’s can file as any one of the four tax entity types: Schedule C’s, S-corporations, Partnerships, and C-corporations. Bottom line: As long as you’re not a C-corporation, this provision has the potential to help you.

So why are C-corps being left out? Well, you’re probably also aware C-corps got a new set of tax brackets in the law that cap out at 21% (compared to their previously top rate of 35%). So they’ve already got their benefit, and this provision is intended to re-equalize the playing field with all their non-C-corporation brethren.

How Does it Work?

So now we know who qualifies, the next question is how is it calculated?

The basic formula is fairly simple: you subtract 20% of your qualified business income on page 2 of your personal tax return. That’s it. Which is pretty amazing — no need to spend money or anything: just multiply and deduct.

Of course “qualified business income” has a technical definition (this is tax law after all), but you can just think of it as the normal profit made by your business. (The definition is meant to exclude things like investment income and capital gains.)

Applying this to an example, assume you have $500,000 business profit for the year flowing onto your personal return. Multiply that amount by 20%, and then subtract that $100,000 right off page 2. Done.

The Wage Limitation

But wait, there’s a catch (there’s always a catch). If your “taxable income” exceeds $157,500 ($315,000 for joint filers), your deduction can be limited.

To see if your income exceeds this amount, go to your tax return, flip to page 2, and look for a line about half way down labeled “Taxable Income”. This is your income after the subtracting adjustments and personal deductions — so it’s not your “gross income” nor “adjusted gross income”, it’s your “taxable income”.

If that number exceeds the threshold above, then your deduction is limited to the greater of:

- 50% of W-2 wages applicable from the business, or

- 25% of W-2 wages applicable from the business, plus 2.5% of qualified property in the business

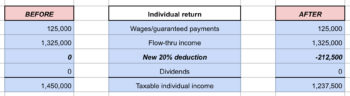

Now that’s a little garbly-gook, but the gist of it is: when your personal income is higher, your pass through deduction could get capped. Here’s an example: Assume you’re a 100% S-corporation shareholder with $1,325,000 in business profit, and $425,000 in W-2 wages paid to employees, of which $125,000 in wages was paid to you. In this case, the new pass-thru deduction is limited to 50% of employee wages ($212,500), and not the standard 20% of business income ($265,000):

(Note: If you don’t own 100% of the business, you’ll be allocated your portion of the company’s wages so you can do this calculation.)

The alternative limitation which can be used instead, is mostly meant for real estate businesses who often don’t have much in the way of W-2 wages. In their case, they can figure their cap by taking the tax basis of the real estate (usually the purchase price) and multiplying it by 2.5%, then adding 25% of wages paid. So a $3,000,000 property making a $500,000 profit with no wages, has a capped $75,000 deduction instead (2.5% of $3m).

One last wrinkle to know about this limitation: while it starts to kick in at $157,500 (or $315,000 joint filers) as mentioned above, it doesn’t take full effect until you reach $207,500 (or $415,000 joint filers). In tax lingo, we call this a “phase-in” range — so if you’re between the threshold and the full effect levels, there’s a pro-ration that goes on, and that math is best left to the professionals (believe-a-you-me).

The Industry Limitation

So we have the basic calculation, and we have the wage limitation — there’s just one more step: if your business is a “specified service business”, the deduction doesn’t just get limited above the threshold amount, it disappears altogether. Yikes.

So who’s a “specified service business”? According to the text of the law:

“Any trade or business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation of skill of one or more of its employees.”

Which is a long-winded way of saying: if the primary thing you’re selling is services, you may get left out in the cold on this deduction. If you’re in one of these industries, the deduction starts to disappear at the threshold amount ($157.5k/$315k joint), and is completely gone by the full effect level ($207.5k/$415k joint).

The question of whether you’re a specified service will be pretty clear for some businesses (e.g. consultants), and less clear for others (e.g. insurance). The law already stated that architects and engineers are okay, but this is certainly going to be one of those areas that gets more guidance released, and gets litigated in the tax courts as the years go on.

Additional Information

So will you end up paying less tax on your return at the end of the day? If you’re under the threshold amounts, most likely yes. If you’re above the threshold amounts, maybe, depending on your particular situation.

But don’t forget: this wasn’t the only part of the tax law to change for 2018 — there were many other significant edits to both business and individual tax provisions, some positive, and some negative. The only way to really know how it will all shake out in your bottom line is to run a tax projection, which we highly recommend for every entrepreneur do at least once a year (and is a standard value provided for all members of The Elements Circle).

Lastly, guess what: unless Congress acts, this whole part of the tax code goes away in 2025.

If you’d like to learn more about the 20% pass-thru deduction with examples, plus hear about other relevant business and personal tax changes for entrepreneurs, you can access our recorded webcast and slides from earlier this month.